Our Awards

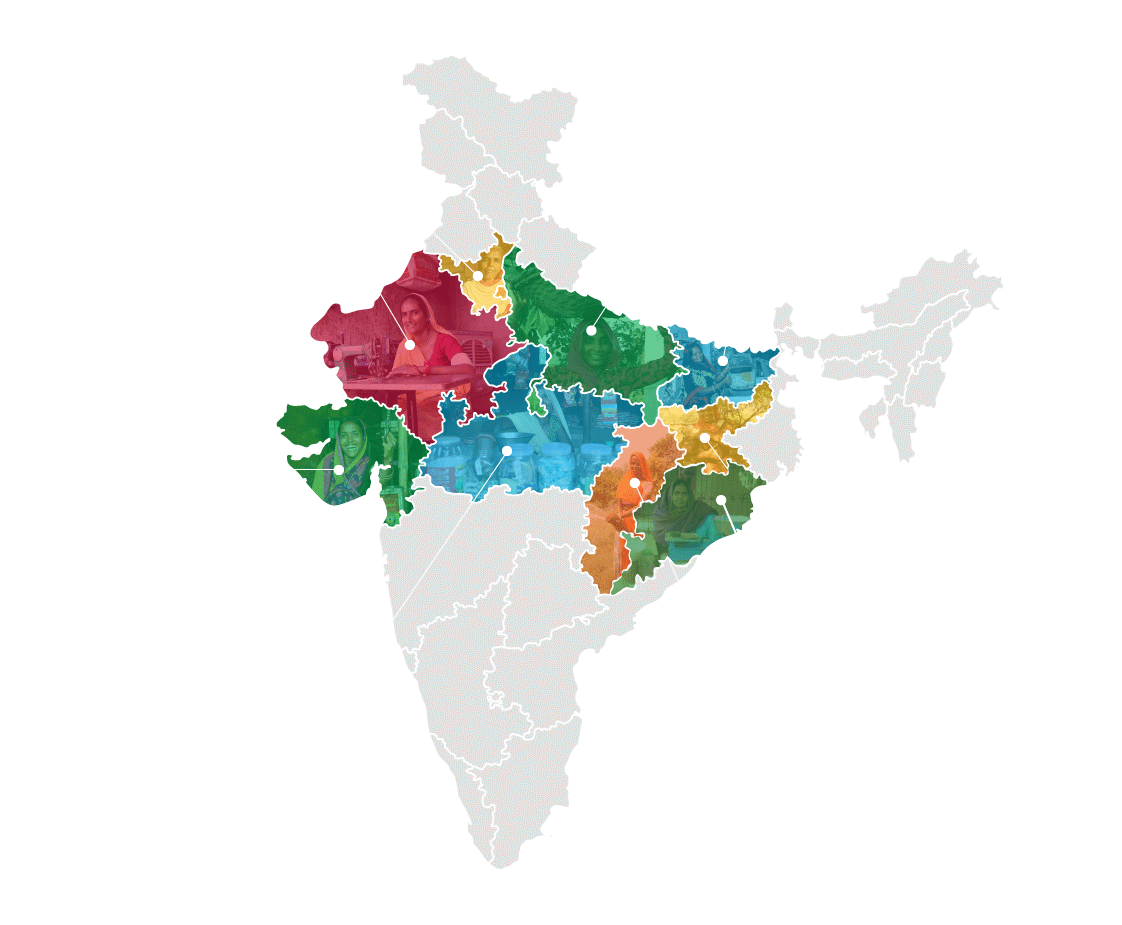

STATES

BRANCHES

CLIENTS

AUM

The name Sindhuja is said to be one of the names of Goddess Lakshmi –the goddess of wealth, fortune and prosperity. Etymologically speaking, this name refers to the avtar of Goddess Lakshmi, who was born out of the river Sindhu.

Sindhuja Microcredit Pvt Ltd (Sindhuja) is a new generation Micro Finance Company which is headquartered in NOIDA . It has received Certificate of Registration from the Reserve Bank of India to operate as NBFC-MFI.

Sindhuja is focussed on meeting the financial and non financial needs of the rural and semi urban population. Currently it is offering Microcredit and insurance services to its clients. It however plans to offer other credit products like Micro Enterprise Loan and also plans to offer pension and other services through third party arrangements to its customers. Through these products it aims to reach the lives of the “Bottom of Pyramid” and the “Missing Middle” customers and contribute in financial inclusion.

Sindhuja Microcredit aims to make financial services easily available to the financially excluded and MSME entrepreneurs through efficient, customer friendly and technology driven solutions.

Our vision is to be one of the most admired financial service providers to over 2.5 million customers by 2025.

Sindhuja aims to provide access to those entrepreneurs who have the requisite skill and courage and conviction but lack capital. Sindhuja aims to support them by offering financial services and also non financial services and be their trusted partner in their growth and prosperity.

In FY 2024, Sindhuja has continued to deliver strong performance. The AUM of the company has increased from Rs.721 Crs in 2023 to Rs. 1009 Crs in 2024 registering a growth of 40%. Our total revenue has increased from Rs.129.8 Crs in 2023 to Rs.222.8 Crs in 2024, registering a growth of 72%. Our Profit before Tax and Profit After Tax have increased from Rs.24.8 Crs & Rs.19.1 Crs in 2023 to Rs.45 Crs & Rs.34 Crs respectively in 2024 . The Gross NPA stood at 1.46% & Net NPA stood at 0.18% as of Mar 24.

The stellar performance of the company attracted two new and very marquee impact investors- Gawa Capital & Oiko Credit. The infusion of Rs.120 Crs capital helped in lowering the leverage to 2.8x & maintain healthy capital adequacy ratio of over 30%. We also added 11 new lenders, taking the total number of lenders to 49. FY 25 is going to be a landmark year for Sindhuja as the Company is expanding its outreach to South & West India by starting operations in Telangana, Andhra Pradesh & Maharashtra.

We are committed to continue to preserve the core values even as we embrace innovation and keep pushing boundaries. By striking a balance between first principles and innovations, we will continue to deliver superlative performance to all our stakeholders -the foremost being our customers.

We find ourselves at a watershed moment, where technological advancements, changing client behaviour, new regulations are reshaping the road ahead.

The industry is transforming, and we must respond with agility, innovation, and a forward-thinking mindset. In fact, we must not only respond but also stay ahead.