Our Awards

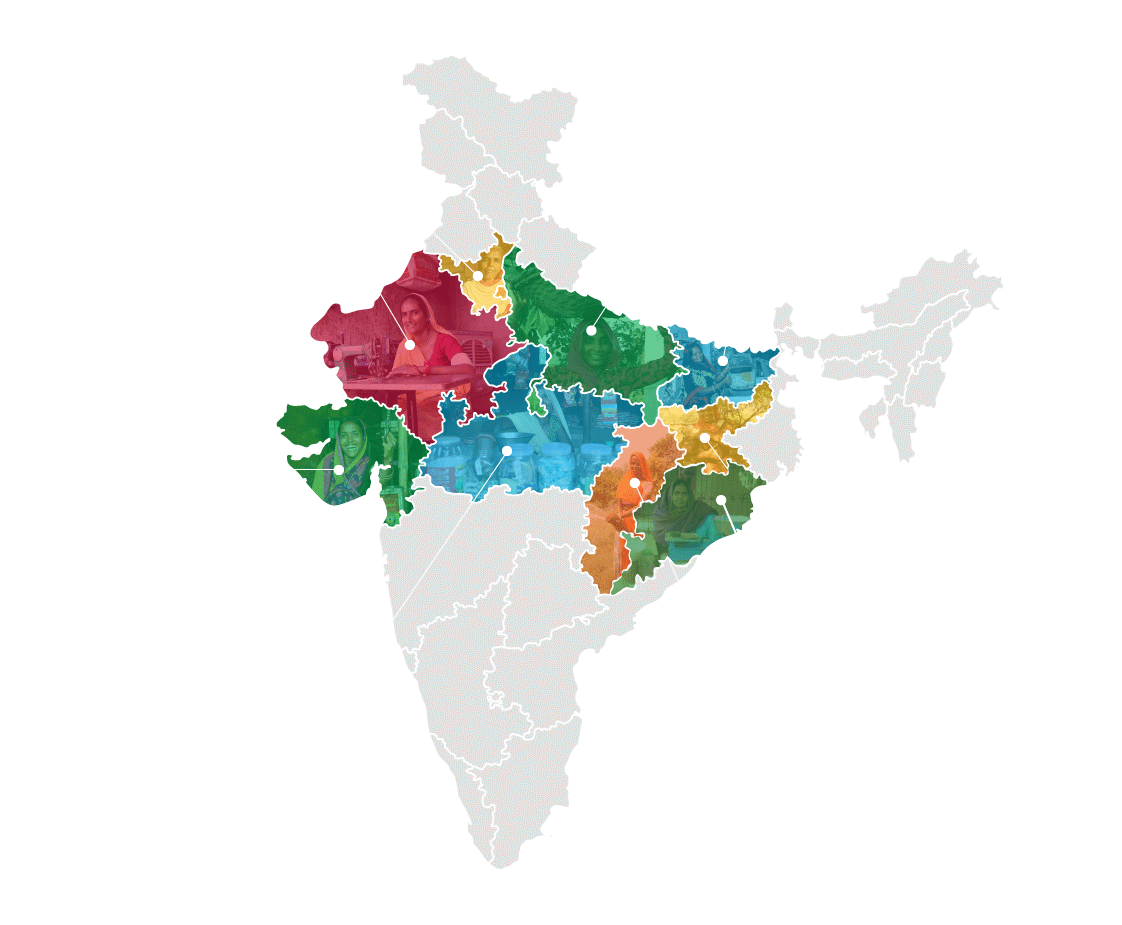

STATES

BRANCHES

CLIENTS

AUM

The name Sindhuja is said to be one of the names of Goddess Lakshmi –the goddess of wealth, fortune and prosperity. Etymologically speaking, this name refers to the avtar of Goddess Lakshmi, who was born out of the river Sindhu.

Sindhuja Microcredit Pvt Ltd (Sindhuja) is a new generation Micro Finance Company which is headquartered in NOIDA . It has received Certificate of Registration from the Reserve Bank of India to operate as NBFC-MFI.

Sindhuja is focussed on meeting the financial and non financial needs of the rural and semi urban population. Currently it is offering Microcredit and insurance services to its clients. It however plans to offer other credit products like Micro Enterprise Loan and also plans to offer pension and other services through third party arrangements to its customers. Through these products it aims to reach the lives of the “Bottom of Pyramid” and the “Missing Middle” customers and contribute in financial inclusion.

Sindhuja Microcredit aims to make financial services easily available to the financially excluded and MSME entrepreneurs through efficient, customer friendly and technology driven solutions.

Our vision is to be one of the most admired financial service providers to over 2.5 million customers by 2025.

Sindhuja aims to provide access to those entrepreneurs who have the requisite skill and courage and conviction but lack capital. Sindhuja aims to support them by offering financial services and also non financial services and be their trusted partner in their growth and prosperity.

The financial years 2020-21 & 2021-22 has been challenging for each one of us. The Covid-19 pandemic has had a significant impact on lives, livelihoods, and the business. Operational challenges mounted due to restricted movement and disrupted supply lines during the first few months of the pandemic. With the second and third wave our focus continues to be on our people’s health & safety, meeting the demand arising out of evolving consumer needs, caring for the communities in which we operate, and finally, protecting our business model. The relentless commitment and dedication of every member of the Sindhuja family helped the business overcome many challenges in the past two years. As a result, we have been able to perform extremely well on all parameters: Adequate Capital, Sufficient Liquidity, Excellent Portfolio Quality, Reasonable Profitability, Robust growth in terms of expansion of states, branches, clients, AUM, Diversification of Funding Sources and Instruments, Geographical De concentration, Reduction in COF and Opex and Achieving the Business Plan.